Cash Me If You Can

Published in February 2020 by Don Anderson @ Legato.

As Canadian entrepreneurs work later and later in life, they are holding a significant proportion of their wealth in their private companies. We're seeing a growing trend amongst owners of all ages to put buy-sell plans in place in the event that one of their shareholders becomes sick or dies. Providing liquidity to cover the value of an ownership stake benefits their widowed spouse or partner and helps facilitate the continued operation of the business.

Having the right agreements in place along with sufficient funds available to meet the requirements of each party to the situation will help create a smoother transition for everyone involved. Entrepreneurs can protect the surviving families and the business itself from the financial consequences of that loss. One way to do this is through a well-structured buy-sell agreement which can lower the financial risk not only for the surviving spouse and their family but also for the surviving business partner(s) and the employees.

When the availability of business credit drives the ongoing operation of the organization, a buy-sell agreement is a means by which to manage the concerns lenders might have about their exposure to risk. It can keep the business moving even after the unexpected loss of a shareholder.

The risk exposure for everyone involved can be significant. A lack of planning can result in severe financial consequences for the widow, the surviving business partner, the company employees, and the firm’s significant creditors. A buy-sell agreement supported by an affordable financial plan can mitigate these consequences.

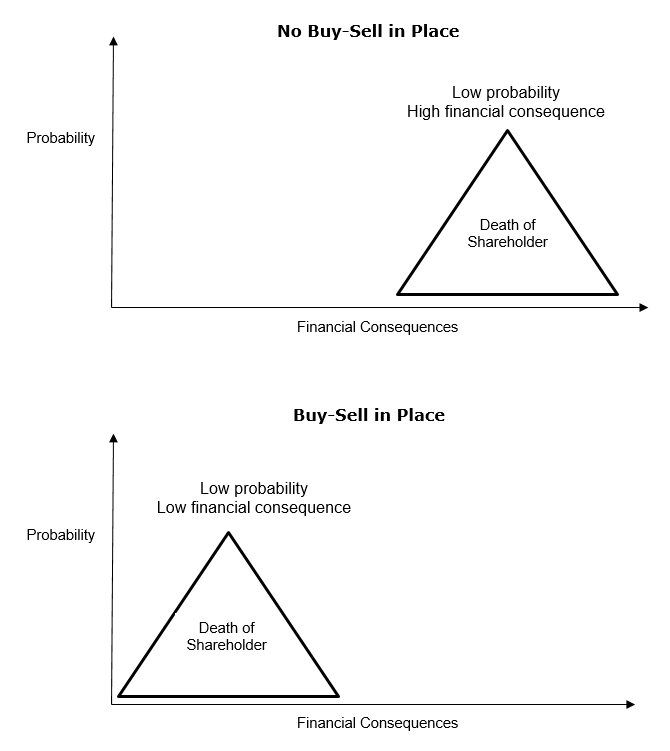

The two graphs below show the difference in the financial outcomes that may result from the death of a shareholder in an organization where a well-drafted and adequately funded buy-sell agreement has been implemented as compared to an organization where no arrangement has been put in place.

Having the right agreements in place along with sufficient funds available to meet the requirements of each party to the situation will help create a smoother transition for everyone involved. Entrepreneurs can protect the surviving families and the business itself from the financial consequences of that loss. One way to do this is through a well-structured buy-sell agreement which can lower the financial risk not only for the surviving spouse and their family but also for the surviving business partner(s) and the employees.

When the availability of business credit drives the ongoing operation of the organization, a buy-sell agreement is a means by which to manage the concerns lenders might have about their exposure to risk. It can keep the business moving even after the unexpected loss of a shareholder.

The risk exposure for everyone involved can be significant. A lack of planning can result in severe financial consequences for the widow, the surviving business partner, the company employees, and the firm’s significant creditors. A buy-sell agreement supported by an affordable financial plan can mitigate these consequences.

The two graphs below show the difference in the financial outcomes that may result from the death of a shareholder in an organization where a well-drafted and adequately funded buy-sell agreement has been implemented as compared to an organization where no arrangement has been put in place.

In concert with several leading legal, accounting & business consulting firms across Western Canada, Legato helps business owners address the financial liability of their shareholders’ agreements using “pennies-on-the-dollar” - well, let’s just say affordably. Nothing is free in this world.

Don Anderson

@ Legato

Don Anderson

@ Legato

All articles are listed here.