Part 1 - The Estate Freeze

Written by Don Anderson, P.Eng. CLU

April 18th, 2024

Written by Don Anderson, P.Eng. CLU

April 18th, 2024

Client Perspectives

"We want our family business and real estate holdings to go to the next generation as smoothly as possible, upon our passing."

Many business owners in their 50s and 60s reach a point in their lives where succession becomes one of their key goals. Let's explore how to create a smooth legacy transition by implementing an estate freeze, and investing in the best possible way to ensure that sufficient monies become available (liquidity) at the needed times in the future.

For clarity, we'll review a case study for a multi-generation business owning family wanting to pass on their lifetime of effort.

To begin, it's important to understand that many of Canada's successful families implement an "estate freeze" combined with "corporate life insurance" to ensure the likelihood of passing their lifetime of effort and investments at the lowest possible cost and impact. So, this planning model should be well understand if succession has become a focus. Guidance by the right legal, tax accounting, and corporate life insurance advisors should be planned, too.

"We want our family business and real estate holdings to go to the next generation as smoothly as possible, upon our passing."

Many business owners in their 50s and 60s reach a point in their lives where succession becomes one of their key goals. Let's explore how to create a smooth legacy transition by implementing an estate freeze, and investing in the best possible way to ensure that sufficient monies become available (liquidity) at the needed times in the future.

For clarity, we'll review a case study for a multi-generation business owning family wanting to pass on their lifetime of effort.

To begin, it's important to understand that many of Canada's successful families implement an "estate freeze" combined with "corporate life insurance" to ensure the likelihood of passing their lifetime of effort and investments at the lowest possible cost and impact. So, this planning model should be well understand if succession has become a focus. Guidance by the right legal, tax accounting, and corporate life insurance advisors should be planned, too.

What Is An Estate Freeze?

|

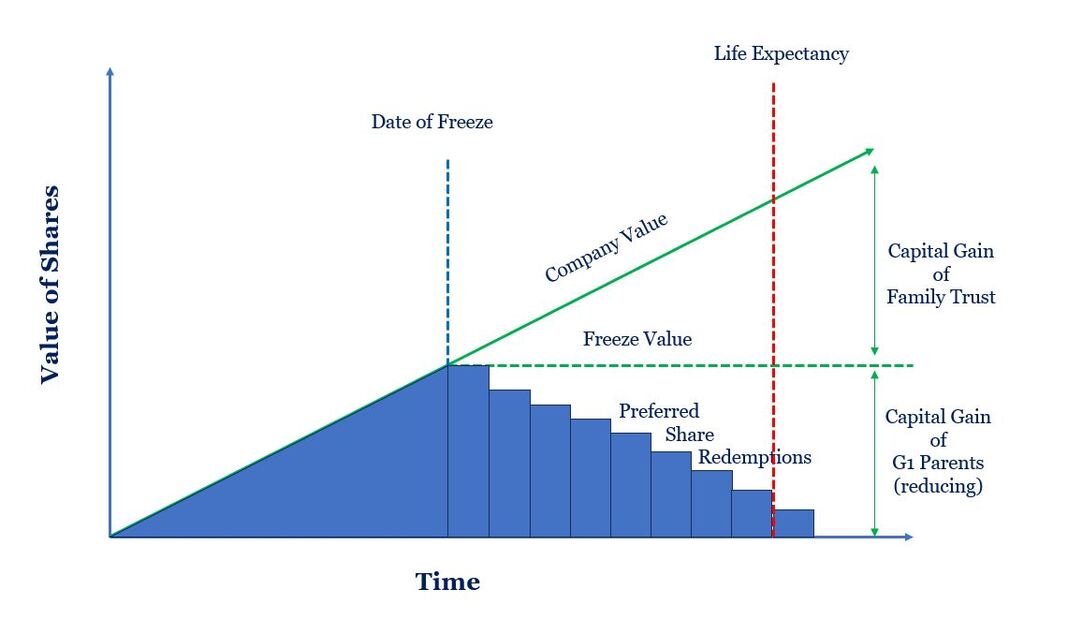

An "estate freeze" defines the process of freezing the value of company shares at the current valuation, with no allowance for growth in value. The "estate" adjective has been added as the freezing process is often done in concert with estate planning.

The "why do it" question gets answered by looking at the owner's goal of succession, which drives the need to plan their estate. An estate freeze gives a fix, defined target for their estate planning. |

So, what steps need to be taken to create an estate freeze?

First step: the current shareholders exchange all of their common shares of their private company for 'fixed value' preferred shares.

Second Step: new shareholder(s), often the next generation of adult children, are issued a new class of common shares. These common shares account for all of the future growth in the value of the company, and are often held in a Family Trust (i.e. G2).

These two ownership changes of the estate freeze shift the future capital gains increases of the company away from the existing G1 shareholders and on to the next generation of adult children. The freeze of the preferred share value defines the amount of capital gains tax that will come due in the estate of the G1 parents. If the common shares are held in the Family Trust, then the freeze process helps the family forecast and plan for the capital gains taxes that may come due with the rollover of the Family Trust in 21 years.

First step: the current shareholders exchange all of their common shares of their private company for 'fixed value' preferred shares.

Second Step: new shareholder(s), often the next generation of adult children, are issued a new class of common shares. These common shares account for all of the future growth in the value of the company, and are often held in a Family Trust (i.e. G2).

These two ownership changes of the estate freeze shift the future capital gains increases of the company away from the existing G1 shareholders and on to the next generation of adult children. The freeze of the preferred share value defines the amount of capital gains tax that will come due in the estate of the G1 parents. If the common shares are held in the Family Trust, then the freeze process helps the family forecast and plan for the capital gains taxes that may come due with the rollover of the Family Trust in 21 years.

Over time, the preferred shares are often redeemed by the company to provide income to those G1 parents and reduce the value of their ownership. This reduction in value lowers the capital gain impact to the estate of the G1 parents, which eases the amount of capital gains taxes that would be due.

Case Study: The Rivers Family

The Rivers family own a successful engineering company. In 2023, the engineering company was valued at $6 million (8 x EBITA). The G1 parents, the only shareholders, have reached 65 years of age. Their 2nd generation (G2) adult children have begun working in the business.

Two key factors have been driving the G1 parents to seek professional advice and plan their estate; the projected increasing value of their engineering company in the years ahead, as well as their concern for the future well-being of their 50-employee work force.

Based on the current growth rate of 7% per year, this engineering company could be valued as high as $23 million in 20 years. Should no change be made in the ownership structure, the estate of the G1 shareholders could face a tax liability burden of up to $6.67M, which is 26.7% of $25M (2023) .

Wait, as the federal government just increased the capital gain inclusion rate to 2/3 as of June 24, 2024, the tax liability for this $25M of capital gain just jumped by $2.27M dollars to $8.9M from $6.67M.

Without creating a plan for the estate liquidity that will be required to pay these taxes, the estate of the G1 parents could be forced to require a fire sale of assets, and face other challenges, thereby risking family harmony and the future livelihood of their company workers.

An Estate Freeze Limits the Estate Tax Burden:

By exchanging their common shares for fixed value ‘preferred shares' using an estate freeze, the G1 parents limit their estate tax burden.

Maintaining Control

Assigning a high allocation of voting rights to each of their preferred share retains control of their company by the G1 parents even once all of their preferred shares have been redeemed, but one.

Deferring Taxes:

Creating new common shares for the future growth in the company with the G2 generation can defer the tax liability of millions of tax dollars for decades.

Protecting The Employees:

Having sufficient liquidity in the G1 estate reduces the likelihood of a fire sale of assets, eases the transition of the company ownership to the G2 adult children, and creates the best possible scenario for business continuity "as usual" for their dedicated employees, after the passing of the G1 parents.

Two key factors have been driving the G1 parents to seek professional advice and plan their estate; the projected increasing value of their engineering company in the years ahead, as well as their concern for the future well-being of their 50-employee work force.

Based on the current growth rate of 7% per year, this engineering company could be valued as high as $23 million in 20 years. Should no change be made in the ownership structure, the estate of the G1 shareholders could face a tax liability burden of up to $6.67M, which is 26.7% of $25M (2023) .

Wait, as the federal government just increased the capital gain inclusion rate to 2/3 as of June 24, 2024, the tax liability for this $25M of capital gain just jumped by $2.27M dollars to $8.9M from $6.67M.

Without creating a plan for the estate liquidity that will be required to pay these taxes, the estate of the G1 parents could be forced to require a fire sale of assets, and face other challenges, thereby risking family harmony and the future livelihood of their company workers.

An Estate Freeze Limits the Estate Tax Burden:

By exchanging their common shares for fixed value ‘preferred shares' using an estate freeze, the G1 parents limit their estate tax burden.

Maintaining Control

Assigning a high allocation of voting rights to each of their preferred share retains control of their company by the G1 parents even once all of their preferred shares have been redeemed, but one.

Deferring Taxes:

Creating new common shares for the future growth in the company with the G2 generation can defer the tax liability of millions of tax dollars for decades.

Protecting The Employees:

Having sufficient liquidity in the G1 estate reduces the likelihood of a fire sale of assets, eases the transition of the company ownership to the G2 adult children, and creates the best possible scenario for business continuity "as usual" for their dedicated employees, after the passing of the G1 parents.

Investing For The Freeze

Having sufficient liquidity to meet the financial obligations of an estate freeze, including all deferred capital gains taxes, can help foster the smooth path of succession for prosperous families.

Conversely, an estate freeze without planning for sufficient liquidity can create rushed asset sales at less than full value, estate execution challenges, and increased familial discord.

In Part 2, we'll explore how to invest well to ensure succession.

Having sufficient liquidity to meet the financial obligations of an estate freeze, including all deferred capital gains taxes, can help foster the smooth path of succession for prosperous families.

Conversely, an estate freeze without planning for sufficient liquidity can create rushed asset sales at less than full value, estate execution challenges, and increased familial discord.

In Part 2, we'll explore how to invest well to ensure succession.

Legato: Your Partner In Estate Tax And Insurance Planning

Business owners and their professional advisors can rely on Legato to collaborate seamlessly. Based on Canada's leading life insurance carriers, our advice can create significant tax and estate benefits to the policy owner(s).

Don Anderson, P.Eng. CLU

Chartered Life Underwriter

Legato Wealth Management Inc.