Legacy Gift of Private Company Shares

Share Redemption By Corporate Life Insurance Payout

Part 1 - Strategy Outline

Posted on February 22nd, 2022 by Don Anderson

Share Redemption By Corporate Life Insurance Payout

Part 1 - Strategy Outline

Posted on February 22nd, 2022 by Don Anderson

|

"I get back more than I give"

A Legato client in winter 2022 As a legacy of their gratefulness to the community, business owners in Canada may wish to support their favourite charitable foundation in their Will yet wonder how to accomplish that goal affordably and in a manner accepted both by CRA and the charity.

|

The strategy outlined here may provide the best answer. We like this method because it's the most affordable and even if their estate does not make a charitable donation after their passing, many benefits will be received as to the business owners' personal finances, family company, and estate from both the financial and legal perspectives.

|

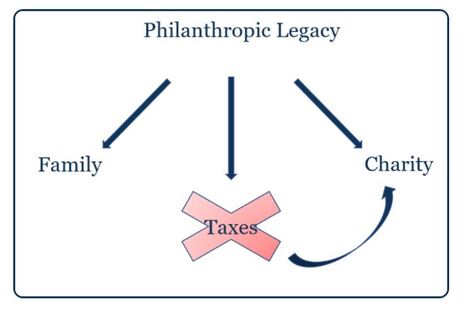

This plan includes three main steps: a freeze of the private company ownership, tax-smart investing through corporately-owned life insurance, and charitable legacy giving. While the in-kind donation of publicly traded securities reduces the capital gain intrusion rate from 50% to 0%, the donation of private company shares does not generate the same tax efficiency. However, there still may be some benefits from the donation of private company shares that make this strategy worthwhile and impactful in many positive ways. |

Tax professionals and legal advisors can dig into the details outlined in Part 2 here. As always, Legato offers guidance and assistance as needed.

Variations of this approach can be developed to meet the particular goals and objectives of each family. Make sure not to over-commit resources or force future actions in case circumstances change over time.

Variations of this approach can be developed to meet the particular goals and objectives of each family. Make sure not to over-commit resources or force future actions in case circumstances change over time.