Legacy Gift of Private Company Shares

Part 2 for Tax Accountants and Financial Planners

First Posted on February 22nd, 2022 by Don Anderson

Part 2 for Tax Accountants and Financial Planners

First Posted on February 22nd, 2022 by Don Anderson

|

Business owners in Canada often wish to support their favourite charitable organization as part of their legacy yet wonder how to accomplish this goal through an efficient, well organized estate plan.

As one example, the strategy outlined here could guide the creation of an afordable, compassionate impact that aligns well with the transition of their company to next generation owners. |

The donation of private shares must qualify as an "excepted gift. See below for further information on that qualification.

The level of detail presented in this article has been prepared to assist detailed-oriented owners and professional advisors such as financial planners, tax accountants, and estate lawyers. Others may prefer to return back to Part 1 now.

|

Information from the Canadian government information about the donation of shares not listed on a public exchange can be read here.

|

Insurance carrier support for this strategy of donating private company share, known as an Insured Excepted Gift, can be read in this documents like this flyer from Sun Life:

| ||

For the donation of private company shares to generate a charitable tax receipt issued by the receiving charity, the donation must be of an "excepted gift". Each of the following criteria must be met for the donation can be considered an "excepted gift".

- The donation must be made in the form of a share.

- The charity receiving the donation can not be a private foundation.

- The donor must deal at arm’s length with each of that charity’s directors, officers, and officials. e.g. The donor cannot be a member of the board of directors of the charity, nor could they have any relation with an official of the charity such as having a spouse or family member on the board of directors. or acting as an official of the charity, paid or not.

- The donated shares must be valued as if those shares were being sold. A professional evaluation will establish the value of the shares received by the charity as well as the value of the charitable donation receipt received by the donor.

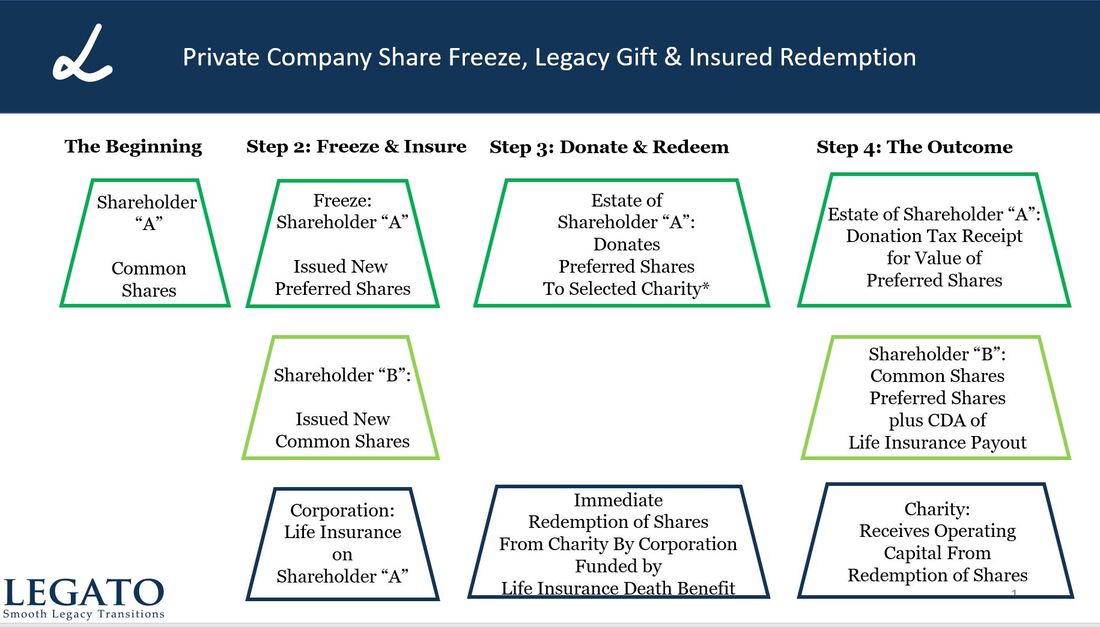

This strategy combines three main elements: an estate freeze, tax-smart investing and legacy giving. Even if the charitable donation does not get accomplished by the estate, the business owners will likely have put their personal finances and their family business in a stronger financial position.

Consider this example of a couple that we'll name Ziggy and Amrita, the shareholders of Cedar and Spruce Inc. (the "Corporation"). Over the past 20 years, President Amrita and CFO Ziggy have built significant equity in their Corporation by focusing on quality, people, and impact. Further to that, they developed a deep level of gratitude towards their local medical community and the associated Hospital Foundation following the survival from cancer of a close friend.

Amrita and Ziggy would like to make a substantial legacy gift to the Foundation using normally available tax incentives while being equally motivated to begin the transition of their profitable and growing Corporation to their three children. Recently valued at $5.0 million, all of the shares of their Corporation are only owned by the couple.

|

To start, Ziggy and Amrita would convert their common shares into an equivalent value of redeemable and retractable preferred shares. New common shares with no fair market value would be created with their three beneficiaries as owners.

Any increase in the value of the Corporation from that point forward would only be attributed to the common shares, effectively "freezing" the value of the parent's ownership in the company and defining the capital gain to be reported in their final estate. |

An amendment to their wills would be needed as well as an agreement between their Corporation and the Foundation. The wills would state that after both Amrita and Jiggy pass away their estate would gift their preferred shares to the Foundation. In the agreement with the Foundation, there would be an understanding that permits the donation of preferred shares from the estate accompanied with a promissory note for redemption by the Corporation.

|

To make this strategy as affordable as possible, Amrita and Ziggy will create a joint and last to die, permanent life insurance policy (Legato3) owned by the Corporation that names both Amrita and Ziggy as the lives insured. The value of the policy should be determined following a review and analysis process with their family and advisors. The amount outlined here has been used for illustration purposes and may not be suitable to each situation.

Having two lives named on the policy reduces the underlying insurance costs while ensuring that the death benefit payout flows into the Corporation only after the second parent dies as that's when funds for the share redemption will be needed. As people often delay putting a strategy like this in place until they're older, it's helpful to know that both parents can be named as the life(s) insured even if one parent has become uninsurable due to health reasons or thinks they're too old to be included. A plan based on two people as a couple can work even if one or both persons has reached their 70s and one person suffers medical issues. |

Upon the second death of Ziggy and Amrita, their estate would gift the parent's preferred shares to the Foundation under the terms of the agreement. The life insurance proceeds deposited into the Corporation would be suitably timed to provide the liquidity that funds the redemption of their preferred shares back by the Corporation.

Important to understand that this strategy does not fall apart if the Foundation refuses to accept the legacy donation of their private company shares from their estate or if changes to the Income Tax Act make an impact. Not completing the legacy donation as part of the estate plans means that the significant liquidity event from the tax-free payout of the life insurance policy will be retained in the Company as will the corresponding CDA credit. Using that CDA, the Company could distribute tax-free dividends to the shareholders, which may include a flow of monies to the parent's estate as a preferred shareholder in order to cover the estate taxes, expenses, and perhaps estate balancing purposes.

The tax consequences of this charitable donation and share redemption strategy will impact the estate of Amrita and Ziggy as well as the Corporation in the following ways:

The reorganization of Ziggy and Amrita's common shares into preferred shares of the Corporation will be tax-deferred assuming the rules of the Act are properly followed.

Important to understand that this strategy does not fall apart if the Foundation refuses to accept the legacy donation of their private company shares from their estate or if changes to the Income Tax Act make an impact. Not completing the legacy donation as part of the estate plans means that the significant liquidity event from the tax-free payout of the life insurance policy will be retained in the Company as will the corresponding CDA credit. Using that CDA, the Company could distribute tax-free dividends to the shareholders, which may include a flow of monies to the parent's estate as a preferred shareholder in order to cover the estate taxes, expenses, and perhaps estate balancing purposes.

The tax consequences of this charitable donation and share redemption strategy will impact the estate of Amrita and Ziggy as well as the Corporation in the following ways:

The reorganization of Ziggy and Amrita's common shares into preferred shares of the Corporation will be tax-deferred assuming the rules of the Act are properly followed.

|

The Corporation's retained earnings shifted into this life insurance policy as policy premiums immediately become exempt from tax in their annual growth. In addition, this investment growth never has to be counted as passive income nor form any part of a small business deduction (SBD) clawback. Yes, this is like holding a lower-yield tax-free investment of Canadian real estate and bonds inside the corporation.

The additional liquidity that flows into the Corporation as the death benefit payout will also be exempt of tax because it's Canadian life insurance. The reasonable investment yield and low risk of this strategy highlight why a couple like Amrita and Ziggy would consider this strategy attractive. |

Long-term life insurance can become self-funding after a number of years, say ten (10) years. In Canada, extra deposits are allowed into these permanent life insurance policies on the understanding that these monies become future premium payments. Yes, this is like holding a TFSA inside the corporation.

With the assumption that the adjusted cost base (ACB) of the million life insurance policy has been reduced down to zero at the time of the second death, the Corporation will receive an equivalent credit to the CDA account.

As the Charitable Foundation is a tax-exempt entity, the dividend declared for redeeming the shares from the Foundation would not need to be a capital dividend. Since this redemption will not be consuming any CDA credit, the full CDA credit associated with the payout of the life insurance policy will remain in the company creating an additional advantage of allowing the tax-exempt distribution of retained earnings to the shareholder(s).

With the assumption that the adjusted cost base (ACB) of the million life insurance policy has been reduced down to zero at the time of the second death, the Corporation will receive an equivalent credit to the CDA account.

As the Charitable Foundation is a tax-exempt entity, the dividend declared for redeeming the shares from the Foundation would not need to be a capital dividend. Since this redemption will not be consuming any CDA credit, the full CDA credit associated with the payout of the life insurance policy will remain in the company creating an additional advantage of allowing the tax-exempt distribution of retained earnings to the shareholder(s).

The personal capital gains tax due to the deemed disposition of their company shares at death would be covered by the charitable tax credit created by the estate donation of their preferred company shares to the charitable Foundation. Several alternatives exist as to the size of the charitable donation relative to the share value.

|

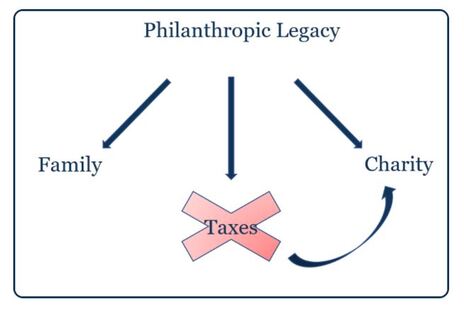

Taxes really have been diverted into charity when the tax benefit from the donation to the Foundation exceeds the capital gains tax due by the estate for the appreciation of those shares.

Donating a higher share value in concert with an increase in the coverage of the life insurance policy could be considered. That change could reduce or even eliminate other income taxes in the year of death while further increasing the tax-free distribution of dividends extracted from the company through the credit to the capital dividend account (CDA).

In this case, a personal donation of $2.7 million of preferred shares to the Foundation after both parents pass will produce a tax credit that could be used to eliminate the $1.35 million of capital gains taxes owed by their estate. |

Careful planning would need to be undertaken in order to make this plan work, especially in ensuring that the Foundation would be permitted to become the owner of the private corporation shares with a promissory note for redemption, even for the expected short period of time. The involvement of the client’s tax advisors and the Foundation's legal advisors would be essential.

For those with a desire to achieve a significant sense of purpose from their life's work, this strategy may prove to be very impactful while affordable.

Don Anderson

Legato

========

Legato

========