Reducing Estate "Shrinkage"

Posted on March 1, 2021 by Don Anderson

Posted on March 1, 2021 by Don Anderson

Key Points:

- With just a few hours of your time and some professional advice, your estate could be worth twice as much.

- Perhaps more importantly, a family-owned company, income property(s) or a vacation home may stay in the family.

- Focus on liquidity and tax-free dividends (CDA).

|

Regular activity, community socialization and a proper diet help maintain positive mental and physical well-being. By following advice from health advisors including Noom or Blue Zone, you may not "reduce your speed" as quickly and be able to enjoy a more active lifestyle as time progresses.

That being said, sometimes the road of life takes an unexpected turn and a dramatic change occurs. To my knowledge, just under 10% of my high school classmates have already passed away due to poor health or a sudden accident and I'm not "old", right? |

Photo by Photoholgic on Unsplash

|

So, where does Legato and "reducing estate shrinkage" fit into this conversation? When we turn the conversation to personal finances, a parallel exists to the discussion of the value of investments and an estate when aided by professional advice and tailored solutions. Let's focus on the issues around an estate and legacy.

First, review the RRSP and TFSA. Investments made into these plans grow tax-free. The RRSP deposit also creates a tax deduction for the contributing tax payer. Maximum amounts limit their potential.

You may be surprised that up to three (3) more tax-reduction opportunities are available to all taxpayers. We'll focus on the long-term solution which we call Legato3 because the coverage can endure even if you live past one hundred years of age. Ah, that's the Blue Zone conversation! The maximum deposits amounts, known as premiums, can be much higher than either the RRSP or TFSA programs. Ownership of a Legato3 policy can be done personally or through a company.

You may be surprised that up to three (3) more tax-reduction opportunities are available to all taxpayers. We'll focus on the long-term solution which we call Legato3 because the coverage can endure even if you live past one hundred years of age. Ah, that's the Blue Zone conversation! The maximum deposits amounts, known as premiums, can be much higher than either the RRSP or TFSA programs. Ownership of a Legato3 policy can be done personally or through a company.

If you've read this far, you may be wondering how this could work for you? You've built up a solid investment portfolio and want to make sure you have sufficient funds for retirement then leave the best legacy possible. The answer? Yes, almost everyone will benefit from professional tax and estate planning advice especially incorporated professionals and business owners.

|

Some entrepreneurs do an orderly windup while they are living, so there’s no need to do too much post-mortem planning. For active operating business owners, tax advisors look at a multitude of approaches.

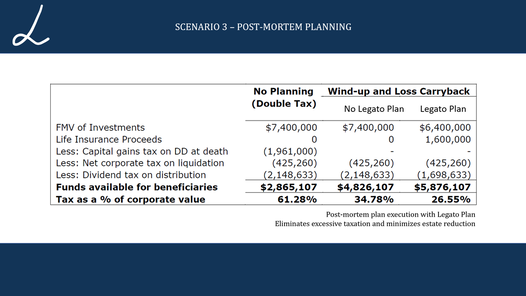

Here's an example of the post-mortem numbers developed for two entrepreneurs holding a valuable investment portfolio within their family corporation. This planning should double the funds available to their beneficiaries. |

As per the details shown above, the tax as a percentage of their corporate value has been projected to be just under 27% compared to "estate shrinkage" of more than 60% had the estate been left unplanned.

|

By shifting a small percentage of their investment portfolio into a Legato3 plan, these entrepreneurs gain tax-sheltered growth of those monies inside the policy. and a tax-free payout of about $1.6M into their corporation at life expectancy. That death benefit creates a large credit to the capital dividend account (CDA) that permits the distribution of tax-free dividends. This liquidity can be used to pay the final tax bills and expenses. Yes, that's a total of three (3) additional tax exemptions introduced because of Legato3.

These "life insurance" advantages protect Canadians in their time of need. The unique attributes can also be used very effectively for estate planning, particularly the parts that lower taxes.

Our corporate Legato3 plans should be the important, tax-advantaged "life insurance" component of every tax and estate plan, particularly for business owners and incorporated professionals. The difference to the beneficiaries will likely be remarkable.

For the young professional or entrepreneur starting out, our Legato for Life strategy helps them begin their path to life-long life insurance coverage at very low cost. Legato for life aims to ensure a transition to the attractive Legato3 solution whenever the affordability suits the policy owner financially, without the need for the person insured to prove good health.

Izipizi as the Italians say.

These "life insurance" advantages protect Canadians in their time of need. The unique attributes can also be used very effectively for estate planning, particularly the parts that lower taxes.

Our corporate Legato3 plans should be the important, tax-advantaged "life insurance" component of every tax and estate plan, particularly for business owners and incorporated professionals. The difference to the beneficiaries will likely be remarkable.

For the young professional or entrepreneur starting out, our Legato for Life strategy helps them begin their path to life-long life insurance coverage at very low cost. Legato for life aims to ensure a transition to the attractive Legato3 solution whenever the affordability suits the policy owner financially, without the need for the person insured to prove good health.

Izipizi as the Italians say.

Don Anderson

Legato

========

Legato

========

This article addresses investment issues applicable to both operating and holding companies that should be used in consultation with the client’s professional advisors and not considered as a substitute for professional advice from an accountant or lawyer.