Freeze, Fund, & Feature

Written by Don Anderson, P.Eng. CLU

Written by Don Anderson, P.Eng. CLU

|

Key Benefits:

|

After working hard for years building up their family company and investment successes, many business owners often reach a point where they want to continue to benefit from that lifetime of effort, ensure that the assets flow to the next generation, and perhaps protect their business, too. By preparing their estate plans now, while they are healthy and capable, business owners can achieve this goal smoothly and affordably.

Quick Summary of the Three Steps:

Freeze the value of the company and investments to lock the current value of the capital gains.

Fund the future estate taxes related to those gains at the lowest possible cost.

Feature the steps of this strategy in the shareholder's agreement and the will(s).

Legato works together with the family, shareholders, and our strategic partners in accounting (freeze), life insurance (fund), and estate law (feature) to create the most affordable, smooth legacy plan.

Freeze the value of the company and investments to lock the current value of the capital gains.

Fund the future estate taxes related to those gains at the lowest possible cost.

Feature the steps of this strategy in the shareholder's agreement and the will(s).

Legato works together with the family, shareholders, and our strategic partners in accounting (freeze), life insurance (fund), and estate law (feature) to create the most affordable, smooth legacy plan.

|

Step 1: Freeze The Estate Value.

The first step will be for the owner's trusted CA/CPA advisor to prepare an "estate freeze" that will fix their asset valuation for business and estate preparation purposes. Business valuation expertise may be available in-house to the accounting firm or provided by a suitable business appraisal service professional. By working with their trusted accountant and the estate lawyer, the business owner(s) can determine which assets to freeze and prepare for the transition. Their corporate lawyer creates preferred shares of the company to be issued to the owners parent(s) in exchange for their common shares. The value of those preferred shares will be fixed relative to the value of the estate forever. Substantial voting rights accompany these preferred shares to ensure that the owners will maintain control of their company over time. The lawyer will also create new common shares to be issued to the next generation family member(s). These common shares will be taking all of the future appreciation of the asset value, and have voting rights that are lower than the voting rights of the preferred shares. |

|

Step 2: Fund Your Estate Thru Legato.

The focus then turns to creating sufficient estate liquidity to enable the owner's personal estate to pay the associated capital gains tax due upon their passing, with the objectives of consuming the lowest amount of corporate retained earnings in order to meet this obligation and enabling this funding for years and even decades ahead until the passing of the owner(s). The personal estate of the shareholder(s) must have sufficient liquidity, at any point in the future, to afford the associated capital gains tax resulting from the estate freeze. Without sufficient liquidity in the estate, an uncertain future and some potentially difficult challenges can be encountered by the estate executor in order to meet the needs of the estate, including but not limited to selling some of their capital assets in order to create that liquidity, paying more taxes, and estate disharmony. As such, this second step of ensuring sufficient liquidity in the owner's personal estate, for every year in the future, should be considered equally as important as creating the estate freeze. At Legato, we like to say "the pair go together": the estate freeze and the Legato Fund! |

Fortunately, business owner families have the opportunity to lower the cost of creating their personal estate liquidity significantly. By funding a corporately-owned Legato Fund (Canadian life insurance) inside their (holding) company over the next few years, the shareholder adds a tax-advantaged policy within their company that features a death benefit pay out perfectly timed with the responsibility for their personal estate to pay the capital gains taxes due from the estate freeze, after their passing.

With this perfect timing, the owner's estate will be able to execute the wishes of the estate freeze successfully, at any point of time in the years ahead.

With this perfect timing, the owner's estate will be able to execute the wishes of the estate freeze successfully, at any point of time in the years ahead.

Creating Estate Liquidity (Example):

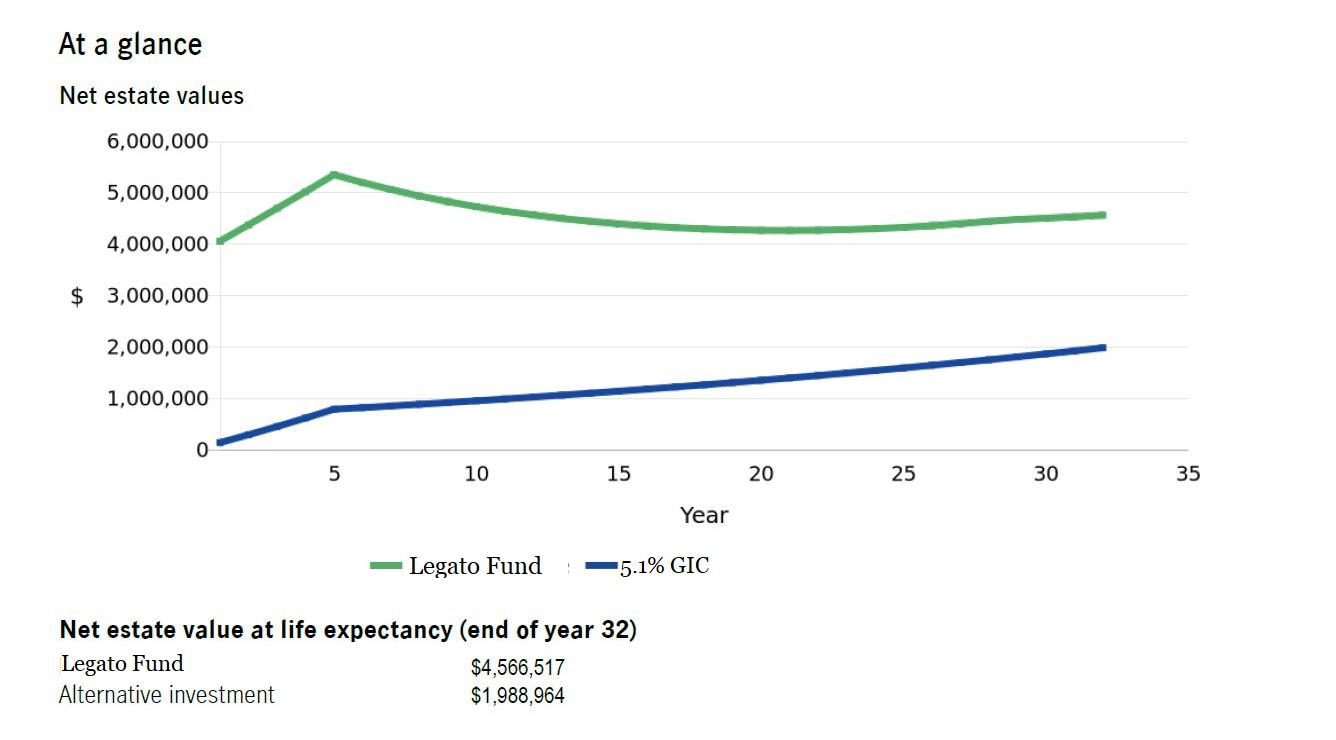

Legato Fund (green) vs 5.1% GIC (blue)

Investing the Same Amounts of Corporate Retained Earnings

Legato Fund (green) vs 5.1% GIC (blue)

Investing the Same Amounts of Corporate Retained Earnings

This chart compares the positive impact to the shareholder's personal estate by investing the same sums of corporate retained earnings into a permanent Legato Fund versus buying 5.1% taxable GICs.

In this example:

The freeze $16M of corporate asset capital gains will eventually create an $8M taxable capital gains tax invoice in the owner's estate after their passing. Assuming a 50% personal tax rate, their estate must send $4M to the CRA to meet this obligation.

Estate Success:

If the owner(s) had shifted their retained earnings into a tax-advantaged Legato Fund and documented their wishes in their shareholder's agreement and will, the estate would have sufficient liquidity to meet the demands of the CRA. The executors would be able to follow the chosen path outlined in the estate freeze to shift those key assets to their next generation of family members.

The higher green line of the Legato plan shows the result: significantly higher estate liquidity in all future years. Typically fully paid up in ten (10) years or so, the Legato Fund creates peace of mind to the business owner and their advisors as their planned, generational transition has the best chance of proceeding with success and family harmony.

Note that Legato partners with each of the leading life insurance carriers across Canada as well as top professional advisors in tax and law. For further information, review our Strategic Relation partnership page found here.

Estate Challenges:

Had the owner(s) done the same $16M estate freeze, not executed steps 2 and 3 outlined here, and kept those same monies in a taxable 5.1% GIC, the executors of their estate would have insufficient funding to fulfill the wishes of the estate freeze and not be able to transition those assets to the next generation beneficiaries without further effort and challenge.

In this example:

The freeze $16M of corporate asset capital gains will eventually create an $8M taxable capital gains tax invoice in the owner's estate after their passing. Assuming a 50% personal tax rate, their estate must send $4M to the CRA to meet this obligation.

Estate Success:

If the owner(s) had shifted their retained earnings into a tax-advantaged Legato Fund and documented their wishes in their shareholder's agreement and will, the estate would have sufficient liquidity to meet the demands of the CRA. The executors would be able to follow the chosen path outlined in the estate freeze to shift those key assets to their next generation of family members.

The higher green line of the Legato plan shows the result: significantly higher estate liquidity in all future years. Typically fully paid up in ten (10) years or so, the Legato Fund creates peace of mind to the business owner and their advisors as their planned, generational transition has the best chance of proceeding with success and family harmony.

Note that Legato partners with each of the leading life insurance carriers across Canada as well as top professional advisors in tax and law. For further information, review our Strategic Relation partnership page found here.

Estate Challenges:

Had the owner(s) done the same $16M estate freeze, not executed steps 2 and 3 outlined here, and kept those same monies in a taxable 5.1% GIC, the executors of their estate would have insufficient funding to fulfill the wishes of the estate freeze and not be able to transition those assets to the next generation beneficiaries without further effort and challenge.

For those interested in hearing about the three tax reducing benefits of investing in Canadian life insurance:

By utilizing these three tax-advantages inherent in a Legato Fund investment, the business owner lowers the cost of creating the needed liquidity in their personal estate upon their passing:

Tax-free accumulation of the investment inside the Legato plan, even if it's corporately owned.

Tax-free payout of the death benefit into the company after the demise of the named life insured(s).

Tax-free dividend payout to the shareholder's estate created by the CDA of the death benefit payout.

By utilizing these three tax-advantages inherent in a Legato Fund investment, the business owner lowers the cost of creating the needed liquidity in their personal estate upon their passing:

Tax-free accumulation of the investment inside the Legato plan, even if it's corporately owned.

Tax-free payout of the death benefit into the company after the demise of the named life insured(s).

Tax-free dividend payout to the shareholder's estate created by the CDA of the death benefit payout.

|

Step 3: Feature This Strategy in The Shareholder's Agreement And Will

The third step of this estate freeze strategy involves updating the company documents and the owner's personal will. By specifying their intentions in these documents, clarity guides the steps for both the estate executor and the company owners to follow, when the time comes. Upon the passing of the life(s) insured, the death benefit payout of the Legato Fund, a life insurance policy, will flow into the company that owns the policy, tax-free. In addition, the company will receive a corresponding credit to the capital dividend fund (CDA). The shareholder's agreement must be updated so that those payout funds will be distributed by the company as a dividend to the estate of the associated shareholder, and the company must be directed to ensure that the distribution will utilize the tax-free dividend allowance (CDA) created by that death benefit payout. The estate estate lawyer must update the will(s) of the owner(s) to apportion those funds that have now reached the shareholder's estate to pay the CRA for the personal estate tax liability associated with this estate freeze. |

By following these three steps, the owner(s) prepares their estate to afford the freeze, transition their defined business assets (business or property) to the next generation, and also provides sufficient legal and tax guidance to their beneficiaries and associated professionals.

Yes, it's as easy as "one, two, three". Putting all three action items into play can help ensure that a lifetime of effort and investment flows successfully to the next generation, smoothly. :-)

Yes, it's as easy as "one, two, three". Putting all three action items into play can help ensure that a lifetime of effort and investment flows successfully to the next generation, smoothly. :-)

Don Anderson, P.Eng, CLU

Chartered Life Underwriter

Legato Wealth Management Inc.

Updated on August 30, 2023

========

Chartered Life Underwriter

Legato Wealth Management Inc.

Updated on August 30, 2023

========