Part 2 - Investing For The Estate Freeze

Written by Don Anderson, P.Eng. CLU

April 18th, 2024

Written by Don Anderson, P.Eng. CLU

April 18th, 2024

Investing Right To Lower The Cost of Succession

Now, let's turn our attention to investing corporate retained earnings in the best possible way to ensure a smooth succession. The investment risk must be low, maximize all tax credits and exemptions available to business owners in Canada, and provide the highest net liquidity when needed; when the G1 parents pass away and, if applicable, when the family trust rolls-over after 21 years.

In this scenario of the Rivers family, the G1 parents wish to address the challenges of the paying the capital gain taxes deferred to their G1 estate, and also assist invest well to help fund the capital gain taxes deferred to the new common shares, likely by way of their family trust that will come due 21 years after the formation of the trust.

Ideally, the family would like to invest in the best way possible now so that the obligation(s) for sufficient liquidity to pay all of those taxes can be met at any time in the future. Yes, the "inevitable" is certain, while the "unexpected" can occur at any time.

In Canada, business owners have the opportunity to gain multiple tax-exemptions and reductions by investing in a corporate life insurance policy, known as a Legato Fund, typically owned and funded by their family holding company. The possibility exists for a policy to be acquired such that the eventual death benefit payout into their holding company, along with the associated CDA credit for capital dividend distribution to their estate, to be sufficient to pay all of the deferred capital gains taxes right from the moment of policy inception that begins with the policy acceptance and first premium deposit.

Since the deferred capital gain taxes will become due immediately upon their passing, the G1 parents could be comforted knowing that the death benefit payout of their corporate life insurance policy would co-ordinate perfectly with the urgent need for their estate to have sufficient net value to meet its obligations.

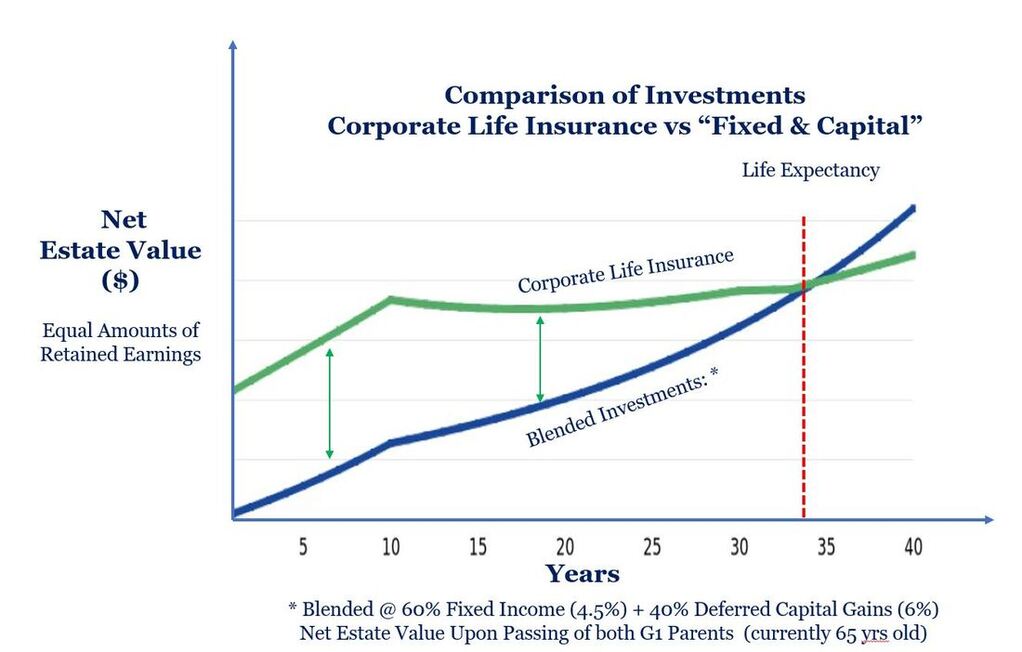

Let's compare two scenarios: investing the same amounts of retained earnings into a corporate life insurance policy versus acquiring blended investments of fixed income and capital products with the same amount of funds. The goal has been defined as maximizing the net amount that reaches the estate of the G1 parents once both of the parents have passed away, and all the deferred taxes come due.

Now, let's turn our attention to investing corporate retained earnings in the best possible way to ensure a smooth succession. The investment risk must be low, maximize all tax credits and exemptions available to business owners in Canada, and provide the highest net liquidity when needed; when the G1 parents pass away and, if applicable, when the family trust rolls-over after 21 years.

In this scenario of the Rivers family, the G1 parents wish to address the challenges of the paying the capital gain taxes deferred to their G1 estate, and also assist invest well to help fund the capital gain taxes deferred to the new common shares, likely by way of their family trust that will come due 21 years after the formation of the trust.

Ideally, the family would like to invest in the best way possible now so that the obligation(s) for sufficient liquidity to pay all of those taxes can be met at any time in the future. Yes, the "inevitable" is certain, while the "unexpected" can occur at any time.

In Canada, business owners have the opportunity to gain multiple tax-exemptions and reductions by investing in a corporate life insurance policy, known as a Legato Fund, typically owned and funded by their family holding company. The possibility exists for a policy to be acquired such that the eventual death benefit payout into their holding company, along with the associated CDA credit for capital dividend distribution to their estate, to be sufficient to pay all of the deferred capital gains taxes right from the moment of policy inception that begins with the policy acceptance and first premium deposit.

Since the deferred capital gain taxes will become due immediately upon their passing, the G1 parents could be comforted knowing that the death benefit payout of their corporate life insurance policy would co-ordinate perfectly with the urgent need for their estate to have sufficient net value to meet its obligations.

Let's compare two scenarios: investing the same amounts of retained earnings into a corporate life insurance policy versus acquiring blended investments of fixed income and capital products with the same amount of funds. The goal has been defined as maximizing the net amount that reaches the estate of the G1 parents once both of the parents have passed away, and all the deferred taxes come due.

Corporate Life Insurance Provides Higher Estate Liquidity

When the estate needs liquidity to pay taxes and fees, the net amount of liquidity available to their estate from investing retained earnings into a corporate life insurance policy far exceeds the liquidity from the blended investments until the 65-year old parents have reached their late 90s.

Three Tax Exemptions Gained By Corporate Life Insurance

Why do the life insurance gain such an advantage? By investing their retained earnings into a corporate life insurance policy in Canada, instead of a taxable corporate investments, the G1 owners gain these tax exemptions and credits, automatically:

tax-exempt investment growth,

tax-exempt death benefit payout,

tax-exempt dividends (credit to the capital dividend account with the death benefit payout).

When the estate needs liquidity to pay taxes and fees, the net amount of liquidity available to their estate from investing retained earnings into a corporate life insurance policy far exceeds the liquidity from the blended investments until the 65-year old parents have reached their late 90s.

Three Tax Exemptions Gained By Corporate Life Insurance

Why do the life insurance gain such an advantage? By investing their retained earnings into a corporate life insurance policy in Canada, instead of a taxable corporate investments, the G1 owners gain these tax exemptions and credits, automatically:

tax-exempt investment growth,

tax-exempt death benefit payout,

tax-exempt dividends (credit to the capital dividend account with the death benefit payout).

Family Trust

Furthermore, as 65+ year-old G1 parents often create a family trust within approximately twenty-one (21) years of their life expectancy, the corporate life insurance policy can also be leveraged to lower the cost of funding the capital gain taxes of the family trust, to the benefit of the G2 shareholders, as well.

If the G1 parents outlive the timing of the Trust rollover, a loan secured by the cash value of the corporately owned policy could be used to pay those capital gain taxes. The loan would be paid out from the death benefit payout of the policy once the surviving spouse passes away.

The utilization of a corporate life insurance policy to lower the cost of paying the 'future capital gain' taxes, in addition to the capital gain taxes coming due in the estate of the G1 parents, should also be considered.

Furthermore, as 65+ year-old G1 parents often create a family trust within approximately twenty-one (21) years of their life expectancy, the corporate life insurance policy can also be leveraged to lower the cost of funding the capital gain taxes of the family trust, to the benefit of the G2 shareholders, as well.

If the G1 parents outlive the timing of the Trust rollover, a loan secured by the cash value of the corporately owned policy could be used to pay those capital gain taxes. The loan would be paid out from the death benefit payout of the policy once the surviving spouse passes away.

The utilization of a corporate life insurance policy to lower the cost of paying the 'future capital gain' taxes, in addition to the capital gain taxes coming due in the estate of the G1 parents, should also be considered.

Legato: Your Partner In Estate Tax And Insurance Planning

Business owners and their professional advisors can rely on Legato to collaborate seamlessly. Based on Canada's leading life insurance carriers, our advice can create significant tax and estate benefits to the policy owner(s).

Don Anderson, P.Eng. CLU

Chartered Life Underwriter

Legato Wealth Management Inc.