52 Years Young

Posted on February 2nd, 2022 by Don Anderson

Posted on February 2nd, 2022 by Don Anderson

|

Born in 1970, you'll be turning 52 years of age in 2022. People who celebrated their 52nd birthday in your birth year of 1970 came into this world "way back" in 1918. They survived two world wars, perhaps changed continents for a better life and have experienced the tremendous impact of technology on the world. If you were raised living in Canada, you grew up with NHL hockey on Saturday night, after school homework and hopefully chores around the house. Today's youth enjoy fast internet, their parents working at home, and consider themselves hard done by having to 'wait until 12" to get their own cell phone.

Life changes fast, as each generation transitions over time into becoming the elders and grandparents of the next. |

|

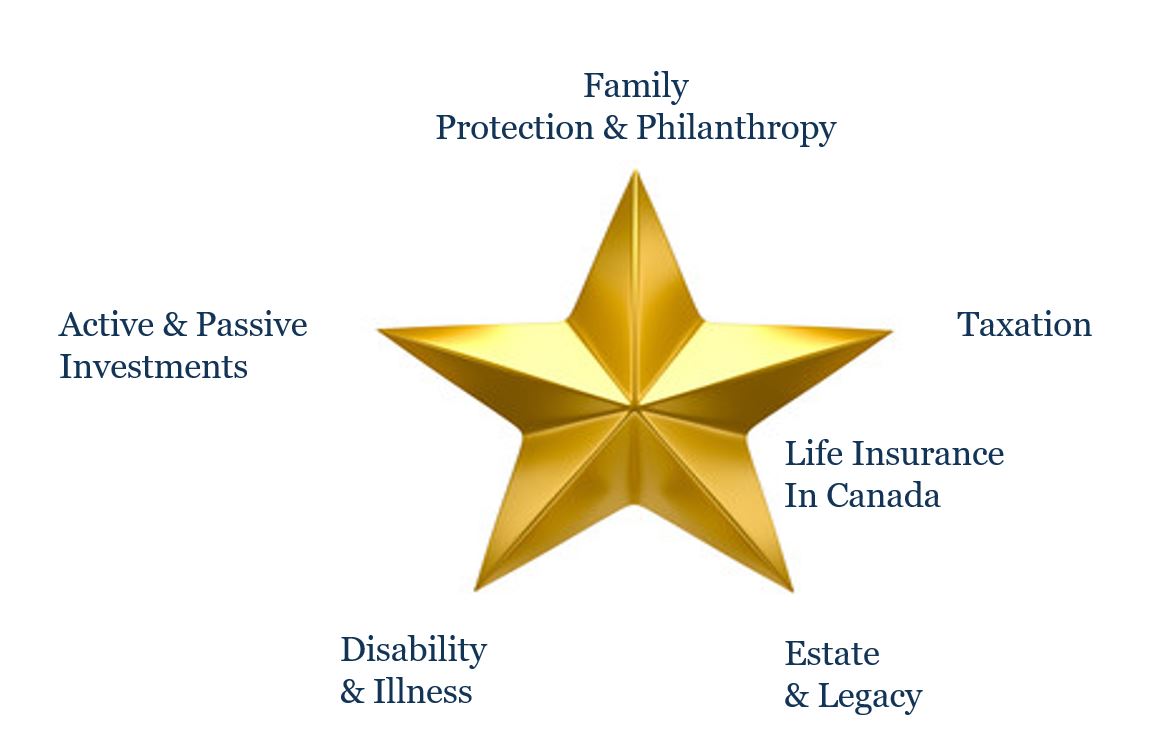

Legato's wide view of wealth planning reaches across five areas, namely family, investing, taxation, disability and illness, and finally estate and legacy. Each one of the areas can present a different set of challenging questions that need answering within each family, often guided by the appropriate professional advisor. Yet each area should be considered connected to the rest. |

To start your wealth planning, pick three questions for your family, or the family that you advise, to consider such as:

If one has dependents, what would change today if either parent had not come home last night?

If one is an owner of a company, what happens when a shareholder passes away?

What can be done to be better prepared in case of cancer or another life changing illness?

For those who have achieved some financial success, perhaps tackle questions such as these:

Will multiple generations benefit from our accomplishment?

Will estate taxes force the sale & prevent succession of our income propeties?

What's the best way in which to be planning a philanthropic legacy?

When enhanced by life insurance in Canada, preparations of that wealth plan could pose questions such as:

If one lives with Parkinson’s Disease, can one's life be insured?

If an existing term policy becomes no longer needed, can it be used in estate planning?

What insurance planning should a young professional couple consider?

Review each pillar in the wealth plan, then pick just one pillar to improve by implementing legal, financial or insurance-based planning changes. Creating a will, power of attorney and health care power of attorney should be top priority, especially when responsible for children or others. Then proceed from there. The time will be well spent and professional advisors or online services can help guide along the way.

That being said, the answer to the ultimate question of life, the universe and everything else is still "42".

Will multiple generations benefit from our accomplishment?

Will estate taxes force the sale & prevent succession of our income propeties?

What's the best way in which to be planning a philanthropic legacy?

When enhanced by life insurance in Canada, preparations of that wealth plan could pose questions such as:

If one lives with Parkinson’s Disease, can one's life be insured?

If an existing term policy becomes no longer needed, can it be used in estate planning?

What insurance planning should a young professional couple consider?

Review each pillar in the wealth plan, then pick just one pillar to improve by implementing legal, financial or insurance-based planning changes. Creating a will, power of attorney and health care power of attorney should be top priority, especially when responsible for children or others. Then proceed from there. The time will be well spent and professional advisors or online services can help guide along the way.

That being said, the answer to the ultimate question of life, the universe and everything else is still "42".

Don Anderson

Legato

========

Legato

========