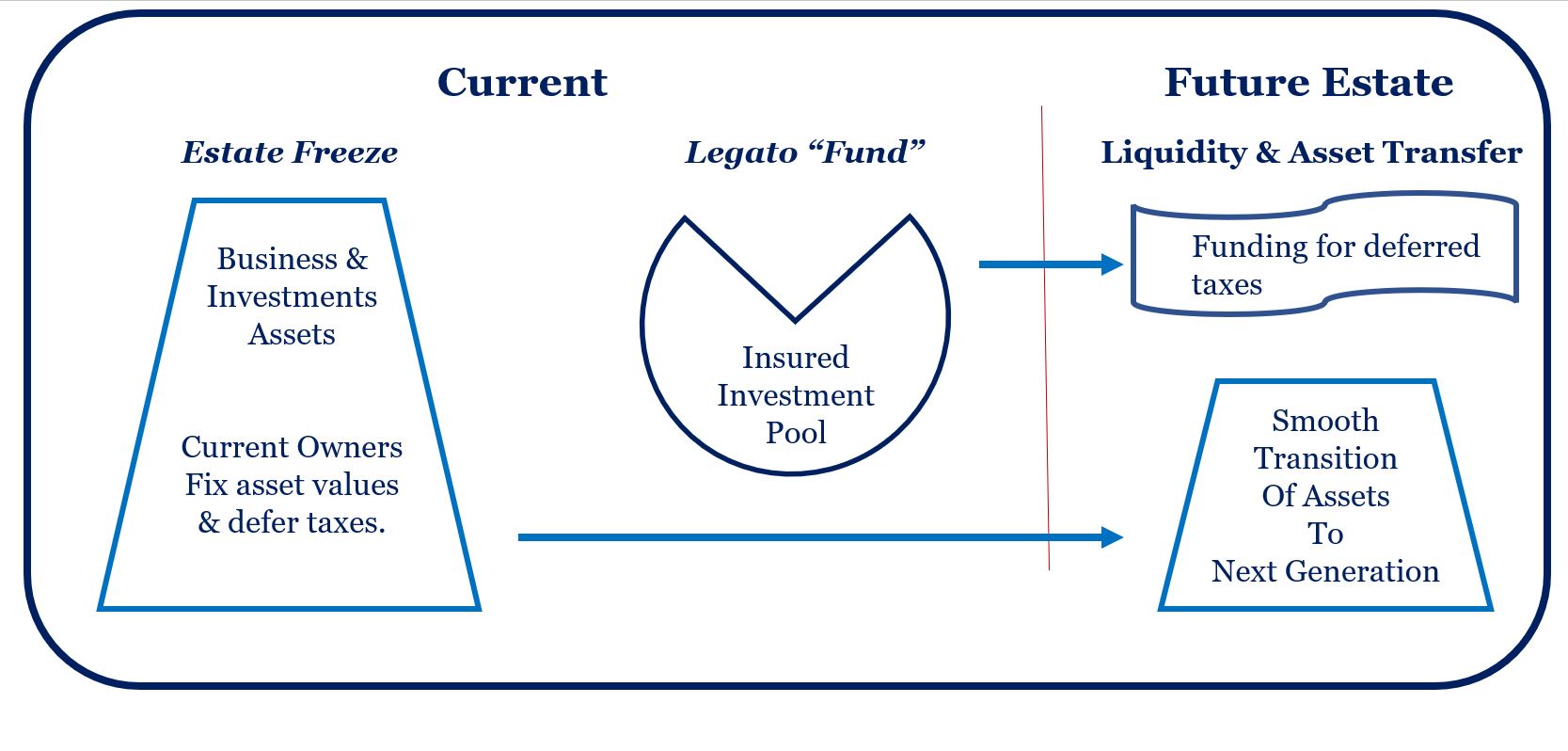

Pair A Legato "Fund" With An Estate Freeze To Ensure A Smooth Legacy Transition.

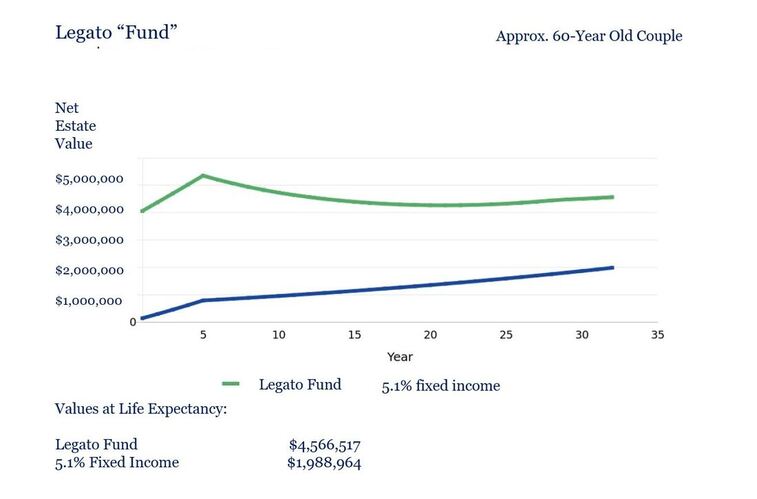

Example - A Legato "Fund" Paired With A $16M Estate Freeze

In this example, a $16M estate freeze creates an estimated ~$4M deferred tax liability that will become due in the estate of the owner(s). The Legato Fund shown in the green line above has been designed to generate at least $4M+ of estate liquidity at any point in the future*. Their estate freeze goals can be accomplished.

By contrast, the same amount of retained earnings invested in a 5.1% fixed income investment would generate less than $2M of estate funding at all times, as show in the blue line. This path would never provide enough estate income for the deferred tax liability. Their estate planning efforts would be in jeopardy.

By investing in a Legato Fund to match their estate freeze, these owners have created their best chance for success.

Considerations

An existing Legato1 (term insurance policy) can be converted into a Legato Fund.

Canadian life insurance companies, called carriers, are not equal in their plans and solutions so Legato works with several of Canada's top life insurance carriers.

Couples can create their Legato Fund together up until their mid 70s, even if one of them is not healthy enough to be insured individually.

An individual up to their early 70s can create their own Legato Fund if they are healthy enough to be insured, which can include being a cancer survivor, living with Parkinson’s disease or having diabetes.

For Tax Accountants and Estate Lawyers

For maximum effect, the Legato Fund should be implemented inside a private corporation, family holding company, or family trust.

Tax-exempt: the annual ~6% DIR (dividend interest yield) earned by the investment within the Legato Fund.

Tax-exempt: the death benefit payout paid to that corporation or family holding company.

Tax-exempt: the CDA (capital dividend account) credit caused by the death benefit payout.

A Legato Fund can considered as a TFSA-like investment account inside an operating or holding company.

* - estimation only.

By contrast, the same amount of retained earnings invested in a 5.1% fixed income investment would generate less than $2M of estate funding at all times, as show in the blue line. This path would never provide enough estate income for the deferred tax liability. Their estate planning efforts would be in jeopardy.

By investing in a Legato Fund to match their estate freeze, these owners have created their best chance for success.

Considerations

An existing Legato1 (term insurance policy) can be converted into a Legato Fund.

Canadian life insurance companies, called carriers, are not equal in their plans and solutions so Legato works with several of Canada's top life insurance carriers.

Couples can create their Legato Fund together up until their mid 70s, even if one of them is not healthy enough to be insured individually.

An individual up to their early 70s can create their own Legato Fund if they are healthy enough to be insured, which can include being a cancer survivor, living with Parkinson’s disease or having diabetes.

For Tax Accountants and Estate Lawyers

For maximum effect, the Legato Fund should be implemented inside a private corporation, family holding company, or family trust.

Tax-exempt: the annual ~6% DIR (dividend interest yield) earned by the investment within the Legato Fund.

Tax-exempt: the death benefit payout paid to that corporation or family holding company.

Tax-exempt: the CDA (capital dividend account) credit caused by the death benefit payout.

A Legato Fund can considered as a TFSA-like investment account inside an operating or holding company.

* - estimation only.

|

Read more in this article from Sun Life:

|

| ||