- Home

- About

- Advice

-

Articles

- Part 1: The Estate Freeze

- Part 2: Investing For The Estate Freeze

- Unlocking Intergenerational Succession

- Freeze, Fund, & Feature

- Tax Apportionment in Estate Planning

- Beneficiary Designations and Resulting Trusts Revisited

- Part 1: Legacy Gifting Private Company Shares

- Part 2: Legacy Gifting Private Company Shares

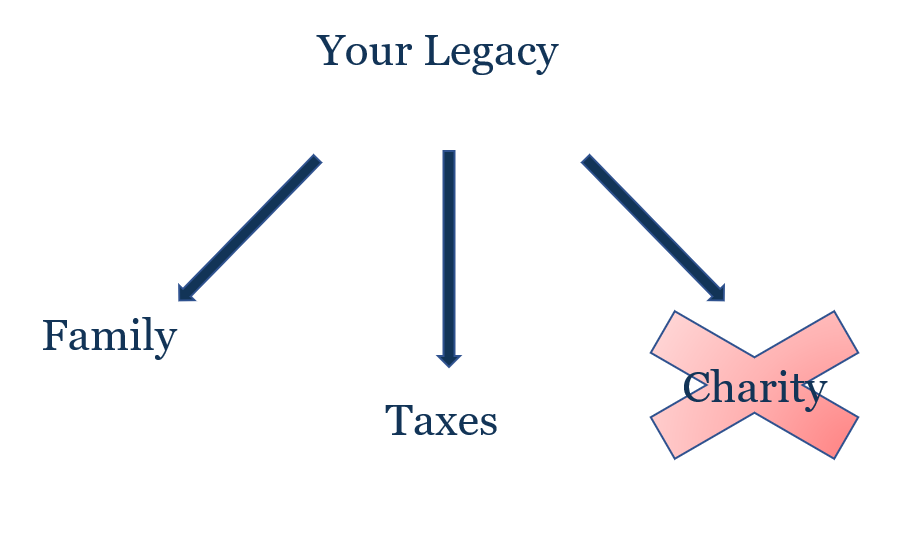

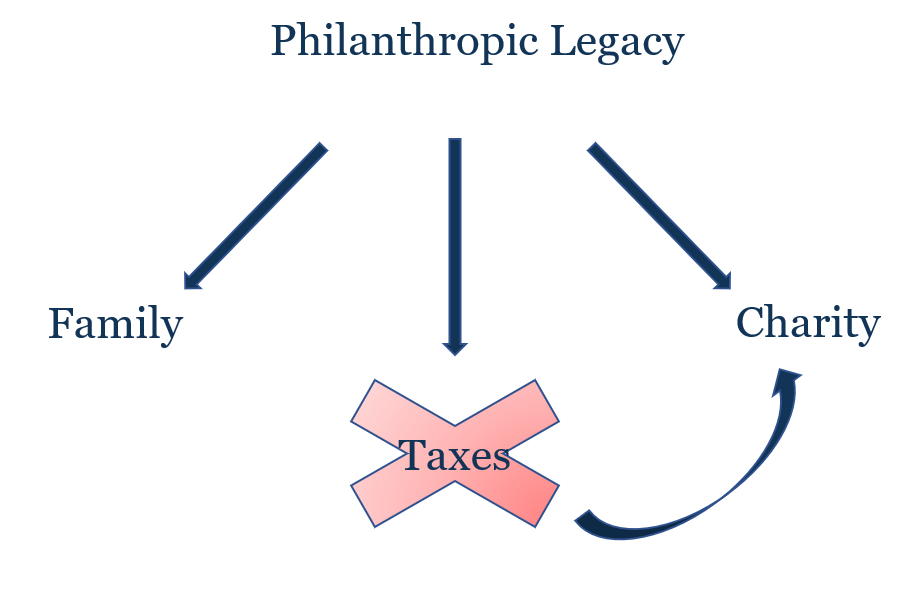

- Reduce Estate Shrinkage

- Take Time For Your Legacy

- Take Five

- Look Across

- Lest We Forget

- Retirement Income

- Review

My PAR Gift

Available via Legato.

Generous Donor

An individual or controlling shareholder of a corporation can donate My Par Gift, a life insurance solution by The Canada Life Assurance Company, through licensed agent Legato.

|

Charity Owned

Any registered charitable organization in Canada can be named as the owner of the My PAR Gift life insurance policy.

|

Designed For Charitable Giving

The registered charity receives the policy payout upon the death of the insured person.

The estimated payout at life expectancy of a $10k donation: $23k for Male 70/Female 70 donors, $35k for Male 60/Female 60 donors, $70k for Male 50/Female 50 donors, $110k for Male 40/Female 40 donors. |

The Minimum

A single deposit of $10,000 can put a My PAR Gift plan in place with a favourite charity.

|

Potential Dividends

As policy owner, the charity can decide to take the annual policy dividends in cash to support their current operations and goals or choose to leave the funds in the policy in order to increase the future payout of the My PAR policy.

|

Financial Flexibility

Over time, each My PAR policy builds up cash value. With guaranteed access to these funds, the charity can access these monies in several ways during the insured person’s lifetime.

|

The Donation

The single premium deposit qualifies as a charitable donation. Once the donor funds the policy, a notification will be sent by Canada Life to the registered charity to confirm the date on which the policy was placed in-force. The donation receipt will be issued by the charity, not by Canada Life.

|

A Specific Year to Donate

If the donor needs certainty regarding the tax year of their donation, the donor should make their donation directly to the registered charity during the desired tax year. The charity can then send that premium deposit to Canada Life to fund the My PAR policy. If a donor pays Canada Life directly, the charitable donation receipt can only be issued in the calendar year once the policy has become in-force.

|