Jim Pattison Leveraged His Life Insurance Policy, Why?

Posted on November 30, 2020 by Don Anderson

Posted on November 30, 2020 by Don Anderson

As their stories have unfolded over the years, each of Jim Pattison, Walt Disney and Ray Kroc have let the business world know that not only did they hold a permanent life insurance policy in the early years of their life and business ventures but also that they were able to leverage that policy at critical times in order to grow their business. By arranging financing with the policy assigned as collateral rather than liquidating the policy for it's cash value, these entrepreneurs obtained key business loans that otherwise may have been denied while also keeping their families protected from the unexpected. They understood how to leverage the value held within this unique asset class during their lifetimes and achieved remarkable success.

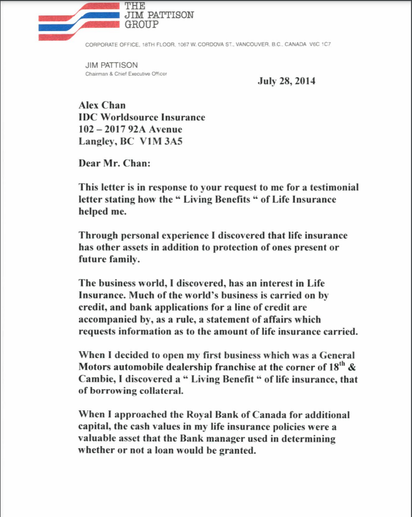

Jim Pattison: In 1961 when Mr. Pattison opened his first business, a General Motors automobile dealership franchise at the corner of 18th & Cambie in Vancouver British Columbia, he persuaded the Royal Bank of Canada to lend him $40,000, which was significantly more than the bank's lending limit. To complete the funding, Mr. Pattison sold his house, assigned the $7,000 of cash surrender value of his life insurance policy to the bank, and gave.a personal guarantee for that loan as did his wife. GM loaned Mr. Pattison $190,000 for the preferred shares in his company, Jim Pattison Ltd.

“If it wasn’t for cash values of my life insurance policies, the bank may have decided against granting me the necessary capital to begin my first business endeavour. I am certainly an advocate of life insurance as a vehicle to help a young person take advantage of business opportunities that may present themselves in the future. It happened to me; it can happen to others. I am grateful for the living benefits of life insurance”

Revenue of the Pattison Group now exceeds 10 billion with just over 45,000 employees.

Walt Disney: In 1955 Walt launched Disneyland in California which may have never opened without the leverage capabilities of his life insurance policy. Unable to secure a bank loan through traditional forms of financing to build Disneyland, Walt scraped together his own financing and collaterally borrowed from the cash value in his policy to help make up the capital required to start construction of the infamous theme park.

Disneyland opened in 1955 and hosted more than 3.5 million visitors in its first year. It continues to be a resounding success, barring the impact of COVID-19.

Ray Kroc of McDonalds: In 1955 Ray Kroc opened his first McDonald’s store, By 1961, he had bought out the McDonald brothers. In the early years when McDonalds was not the financial success it is today, Kroc borrowed money from two life insurance policies (and also his bank) in order to cover the salaries of his key employees and to build an advertising campaign around the soon to be famous mascot, Ronald McDonald.

McDonald’s grew to more than 700 restaurants in the next 10 years.

Both businesses and individuals can take advantage of the value held within their permanent life insurance policy. Most of the significant Canadian insurance carriers offer permanent coverage and each policy can be structured to suit the goals and objectives of the applicant family.

Important Information

The information in this material is derived from various sources. Material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness.

This report was originally published on Linkedin by Jamie Deba, Employee Benefits & Corporate Life Insurance at HUB International Insurance. HUB is Legato's MGA.

Jim Pattison: In 1961 when Mr. Pattison opened his first business, a General Motors automobile dealership franchise at the corner of 18th & Cambie in Vancouver British Columbia, he persuaded the Royal Bank of Canada to lend him $40,000, which was significantly more than the bank's lending limit. To complete the funding, Mr. Pattison sold his house, assigned the $7,000 of cash surrender value of his life insurance policy to the bank, and gave.a personal guarantee for that loan as did his wife. GM loaned Mr. Pattison $190,000 for the preferred shares in his company, Jim Pattison Ltd.

“If it wasn’t for cash values of my life insurance policies, the bank may have decided against granting me the necessary capital to begin my first business endeavour. I am certainly an advocate of life insurance as a vehicle to help a young person take advantage of business opportunities that may present themselves in the future. It happened to me; it can happen to others. I am grateful for the living benefits of life insurance”

Revenue of the Pattison Group now exceeds 10 billion with just over 45,000 employees.

Walt Disney: In 1955 Walt launched Disneyland in California which may have never opened without the leverage capabilities of his life insurance policy. Unable to secure a bank loan through traditional forms of financing to build Disneyland, Walt scraped together his own financing and collaterally borrowed from the cash value in his policy to help make up the capital required to start construction of the infamous theme park.

Disneyland opened in 1955 and hosted more than 3.5 million visitors in its first year. It continues to be a resounding success, barring the impact of COVID-19.

Ray Kroc of McDonalds: In 1955 Ray Kroc opened his first McDonald’s store, By 1961, he had bought out the McDonald brothers. In the early years when McDonalds was not the financial success it is today, Kroc borrowed money from two life insurance policies (and also his bank) in order to cover the salaries of his key employees and to build an advertising campaign around the soon to be famous mascot, Ronald McDonald.

McDonald’s grew to more than 700 restaurants in the next 10 years.

Both businesses and individuals can take advantage of the value held within their permanent life insurance policy. Most of the significant Canadian insurance carriers offer permanent coverage and each policy can be structured to suit the goals and objectives of the applicant family.

Important Information

- Information contained in this article has been based on the legislation and administrative policies of the Canadian Income Tax Act (ITA) and is subject to change.

- Coverage is subject to medical approval and a written application.

The information in this material is derived from various sources. Material is provided for general information and is subject to change without notice. Every effort has been made to compile this material from reliable sources; however, no warranty can be made as to its accuracy or completeness.

This report was originally published on Linkedin by Jamie Deba, Employee Benefits & Corporate Life Insurance at HUB International Insurance. HUB is Legato's MGA.

Don Anderson

Legato...for Life

Legato Wealth Management Inc.

Vancouver, British Columbia

Legato...for Life

Legato Wealth Management Inc.

Vancouver, British Columbia