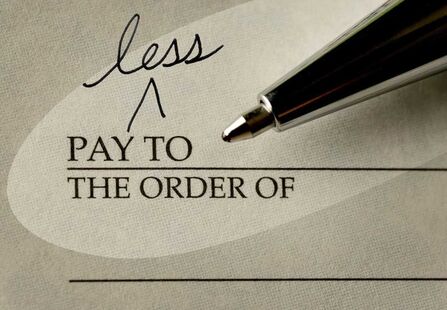

Four Tricks That The Wealthy Use That Ordinary Canadians Can Try, Too

Published in February 2020 by Don Anderson @ Legato.

Four tricks that the wealthy use to reduce their taxes are also strategies that ordinary Canadians can implement, too.

No surprise that the final recommendation is for permanent insurance, which we call Legato3.

Click on the image above to read the full article posted in the Financial Post.

Don Anderson

@ Legato

No surprise that the final recommendation is for permanent insurance, which we call Legato3.

Click on the image above to read the full article posted in the Financial Post.

Don Anderson

@ Legato

All articles are listed here.